When I gave an investment talk in New York City this summer at Seeking Alpha’s Investing Summit, I shared simple tactics with participants to make more money and invest more efficiently. One statistic I quoted was that only around 7% of savers were getting within 100 bps of the wholesale Fed Funds rate on their savings, while over half were getting zero. For most people, the quickest way to fix this is to open an account with Vanguard and deposit money– their default money market fund that you’re automatically invested in is virtually unmatched for how much interest is passed through to you. The difference adds up to thousands of dollars per year for many savers with no additional risk.

On the other side of the spectrum, there are forums on websites like Vanguard forum Bogleheads where a lot of people in their 30s and 40s who are retired early from tech tend to congregate. Users on Bogleheads built a spreadsheet that not only optimizes the amount of interest you can earn, but it automatically pulls real-time data and optimizes for what earns you the highest amount of after-tax interest after federal and state income taxes. And this spreadsheet is free, created by Bogleheads user “retiringwhen”. I love it!

Here I’ll share a link to the Bogleheads spreadsheet for Vanguard and Fidelity. It’s in Google Sheets, it won’t function properly in Excel due to the need to pull real-time data, but Google Sheets works just as well. The full discussion on the spreadsheets is here, and if you go to the most recent part of the thread you’ll be able to find future updates. They also have another spreadsheet that covers the entire universe of money market funds and ETFs.

There are instructions on how to use it on the first page, but I’ll reiterate.

The master spreadsheet is read-only, you need to make a copy of the spreadsheet so you can use the data yourself.

Then, go to the My Summary page and enter your state of residence and tax rates.

Go to the VG Charts page to see the backtest.

Example #1– Top Tax Bracket In Texas

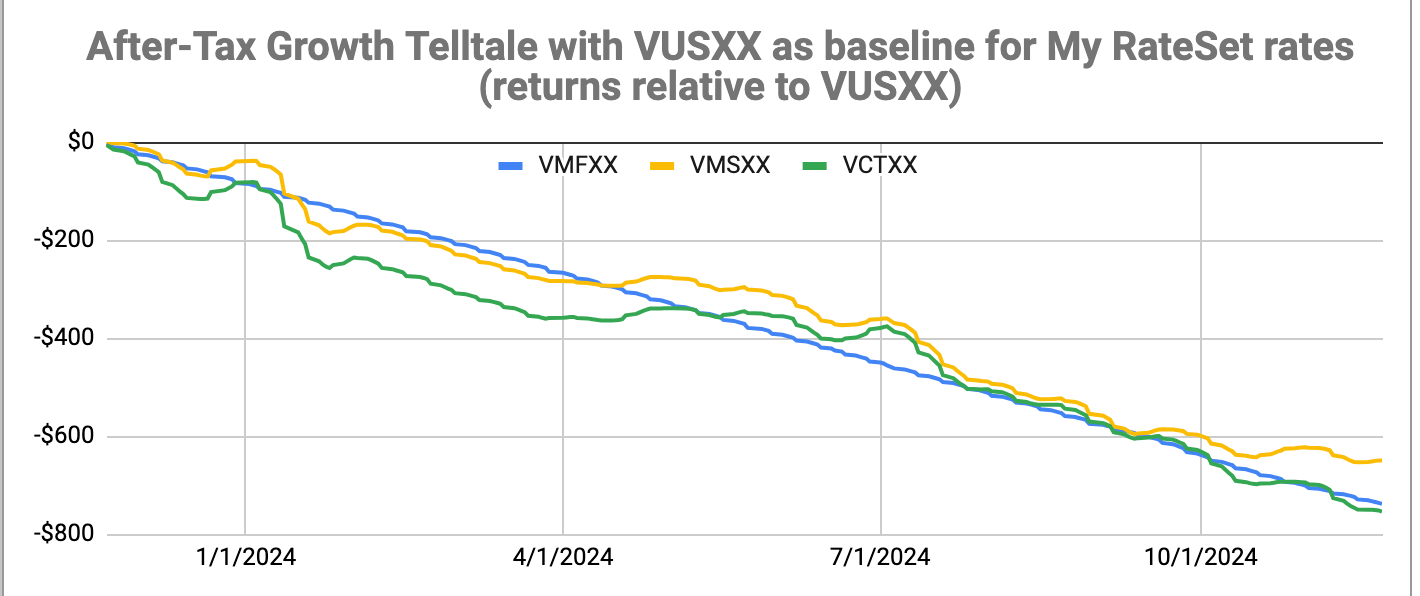

The first example I’ll give is for high earners making $1 million-plus in Texas or Florida. Because the top income tax rate on interest is currently 40.8% (37% income tax plus 3.8% medicare surtax), there is a benefit to using municipal money market funds like VMSXX, which Vanguard offers.

I did some research into this– at first I thought municipal money market funds were a slam dunk, then I looked and thought they were useless, and now with the full spreadsheet I can tell you that they’re moderately useful. The reason why this is– due to wonky SEC reporting requirements, published yields you see when you get quotes on municipal money market funds are unreliable and fluctuate throughout the month. You need a spreadsheet like this to make an accurate backtest and understand whether you’re likely to come out ahead or not.

The Finance Buff has a good article explaining this in more detail, but I’ll share the key insight into what this means in a picture.

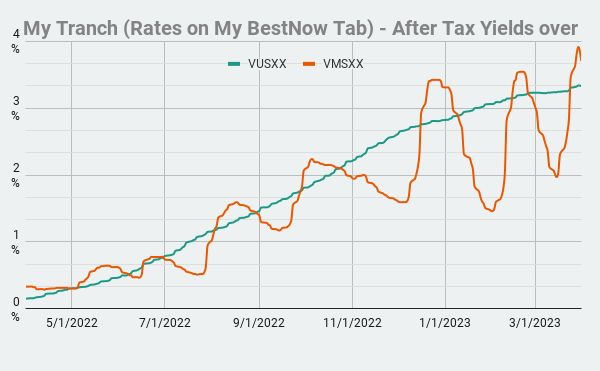

Source: The Finance Buff

As you can see here, the 7-day municipal money market yields fluctuate throughout the month due to the timing of the interest payments, while the taxable yields are steady. Whether you make more or less after tax depends on your income tax rate.

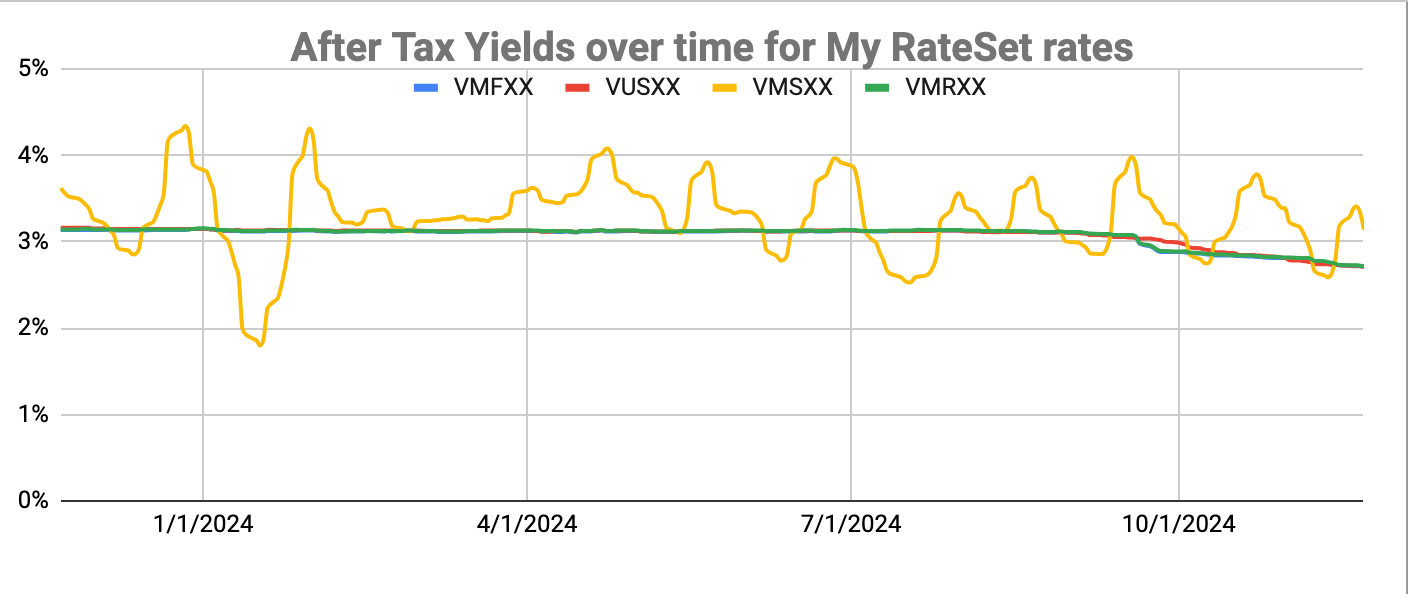

My research has found that if you’re in the top-income tax bracket and in a no-income-tax state, you’re going to do better by investing in Vanguard’s municipal money market fund (VMSXX).

Here you can see that the municipal money market yield is above the taxable yield on average.

I ran the numbers for someone holding $250,000 in cash in their investment account, and you come out about $500 per year better, or 20 bps. To be fair, this is lunch money. Also, if you’re in the 35% bracket, it’s basically a wash. Below that, you’re clearly better in Vanguard’s default money market fund (VMFXX).

There are plenty of high earners out there who aren’t even earning any interest at all on their cash– I know a few, and they’re leaving $5-10k annually on the table. However, if instead you want to rigorously optimize, this is how it’s done. There are also some scenarios where you might compound your advantage and this might be more useful. For example, if you sold a business for a few million dollars and planned on buying into the stock market over time, using the municipal money market fund would save you tens of thousands of dollars in taxes.

So this does have some use– if you’re in the top tax bracket it will generally save you some money to use Vanguard’s municipal money market fund. And you can easily quantify how much using the spreadsheet. As you’re about to see though, the real punishment on interest earnings comes from state income taxes, and fortunately, that part is easier to get around.

Example #2: Top Tax Bracket In California

I thought this was an interesting example as well– I ran the same numbers for California household earning $1,000,000 or so per year. That means that your top tax bracket would be 40.8% federal plus 13.3% California. California taxes interest as well, but they’re not allowed to tax interest from Treasuries and a few other select types of government obligations. This flips the tax incentive, California investors actually do best by investing in a Treasury-only money market fund. Standard money market funds make a lot of investments in the repo market, and California, New York, and other states tax the interest from these transactions. Also notable is that California is allowed to tax the interest on municipal bonds, which makes municipal bond strategies far less effective in general, but especially for money market funds.

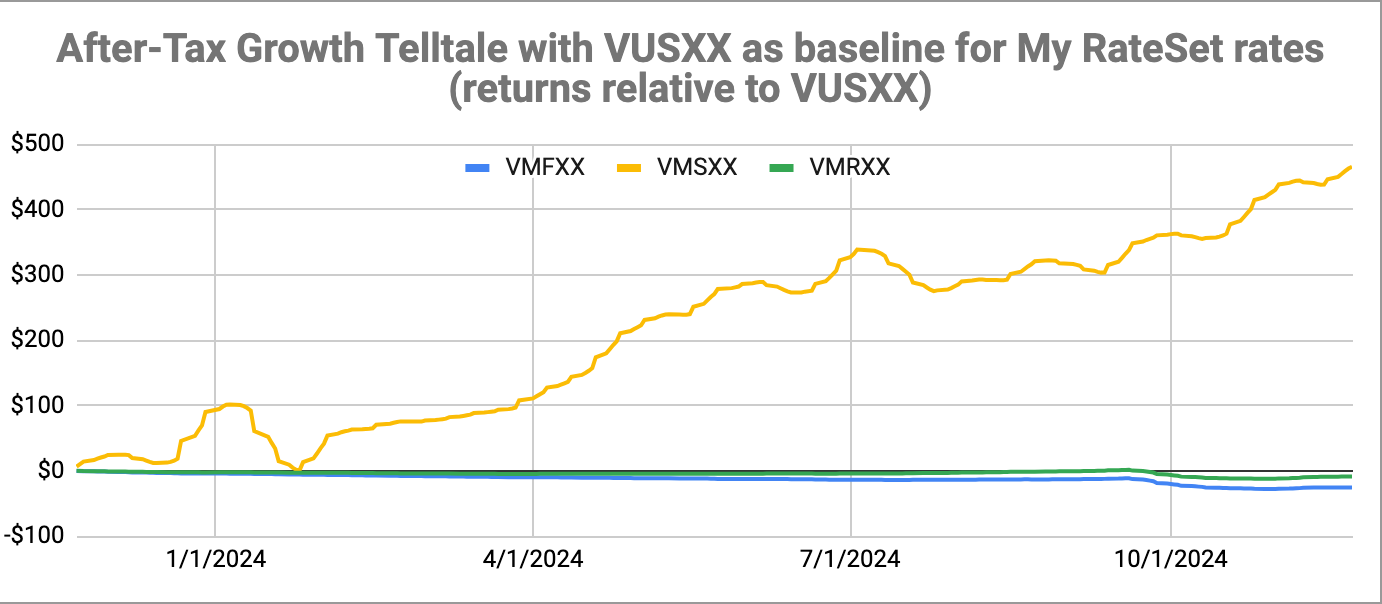

Here we can see a persistent advantage for Vanguard’s Treasury money market fund due to avoiding California tax.

But what about the special California municipal money market funds that Vanguard offers? It doesn’t offer any value– the yields are too low to offset the taxes. Vanguard has a New York money market fund that seems to offer a bit of value over Treasuries for very-high-income NYC residents, but it’s not much. Note that Vanguard only has state-specific funds for NY and California.

For the same parameters, the California taxpayer underperforms VUSXX by about $700 per year in munis, and the California money market fund is even worse.

Example #3: Typical Affluent Household With State Income Tax

For my third example, I’ll plug in the numbers for a typical affluent household making $200-300k and in a state with an income tax. If you’re married, this generally puts you in the 24% tax bracket federally, your state taxes depend on what state you live in.

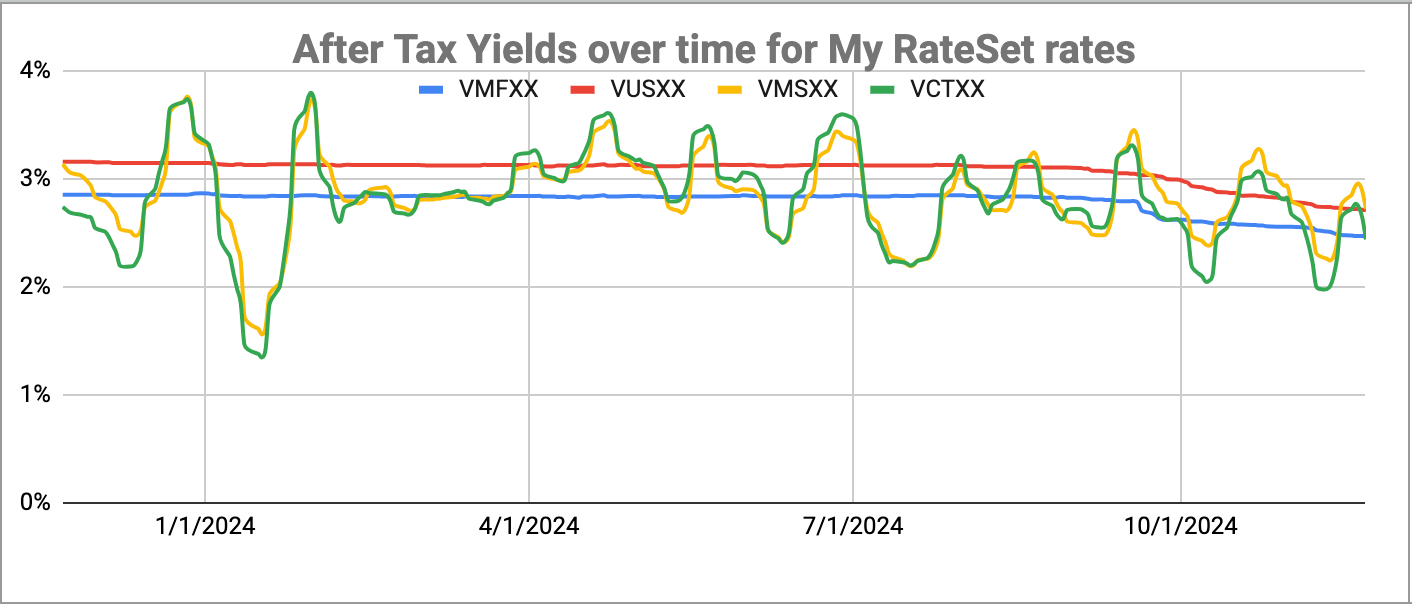

We’ll go back to the well with California here since there are so many affluent households there. Here the Vanguard Treasury money market fund out-earns the typical money market fund by 20 bps, and the municipal money market funds by a whopping 100 bps.

The red here is Vanguard’s Treasury Money Market Fund (VUSXX), you can see that it crushes the other funds. I ran the numbers for Virginia, Connecticut, Maryland, and New Jersey as well, and the conclusion is essentially the same– Treasury money market funds win if your state taxes interest.

Findings:

Earners in the top federal tax bracket in Texas, Florida, and other states with no income tax gain some benefits from municipal money market funds, especially if they hold a lot of cash.

Households in the 35% tax bracket and below in no-income-tax states are best served by Vanguard’s default money market fund (VMFXX).

Earners of all income levels should use Treasury-only money market funds (VUSXX) if their state charges an income tax. Those in high-tax states like California and New York benefit more.

These findings are based on backtests, and you should run the numbers for yourself with the spreadsheet here.

Bottom Line

Most people I encounter are leaving a few thousand dollars per year on the table by keeping cash in accounts that pay zero or low interest. At the other end of the spectrum, there are people with spreadsheets to milk every after-tax penny out of the market. For those who want to truly maximize the amount of interest they get on an after-tax basis, this spreadsheet is golden. And remember that I’m not your financial advisor, so consult with yours.

Another option for savers is TFLO, iShares Treasury Floating Rate Bond ETF. It invests solely in short term Treasuries. The current sec yield is 4.69%